Home insurance policies are essential for homeowners who want to protect their home from the unexpected. This coverage can cost you differently depending on your location. Bundling insurance policies with other carriers can save homeowners money. You can also get discounts.

Massachusetts's average home insurance costs are $1,261 each year. This is a significant amount less than the national average of $2,864 annually. The rate you pay will depend on where you live and how old your home is. In general, homes older than 50 years are more expensive to insure. Older houses are made with less durable materials. They might need to be rebuilt to meet safety codes.

Another factor that affects the cost of a homeowner's policy is the deductible. Typically, a homeowner's deductible will be $1,000 or more. Your home insurance premium will be determined by the amount of coverage that you need, in addition to your deductible.

Ask about discounts when choosing an insurance company. Higher rates can be obtained if you have excellent credit. Discounts are also available for security systems. You can also expect to pay higher premiums for homeowners with a history in claims.

A number of rooms within your home is another factor that could affect your policy. Higher risk of a claim for homes with more rooms is a higher probability. A pool is also a separate structure that is not covered under standard dwelling coverage.

Many insurance companies will consider the cost of repairing or rebuilding your home if you have a claim. Age can affect the cost of repairs. Repairing or replacing older electrical and plumbing systems can be more expensive. The cost of custom molding and plaster walls can also increase the cost for your policy.

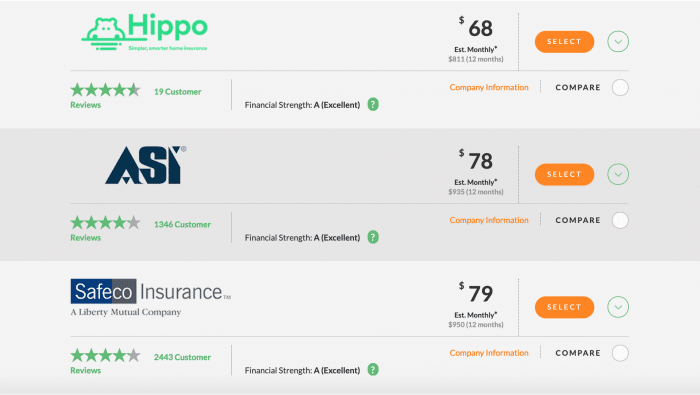

During the course of the year, your home insurance cost can fluctuate by hundreds of dollars. It is best to shop around and find the lowest price. One option is to choose a home insurance company that works with a local independent agent. You may also compare the prices of several insurers.

The home insurance calculator can help estimate your deductible, as well as the rates for liability. Because of the risk of flooding and hurricanes, you'll likely have to pay higher for insurance if you live on the coast. On the other hand, inland towns have a lower risk of major storms.

Massachusetts is home to many insurance companies. The average home insurance premium in Massachusetts is slightly higher than the Rhode Island one. However, if you reside in Boston, your annual home insurance premium will be more than 1000 dollars.

Although homeowners insurance is not required, many mortgage lenders require that you have one. When determining your premium, insurers consider factors like crime statistics, weather damage, and labor costs.