Car insurance rates are affected by several factors including your driving record. While drivers with good driving records tend to pay the lowest rates for car insurance, those with poor driving records may see their rates rise by hundreds of dollars. You will be able to save money on your auto insurance by keeping your driving record clean. It will also make renewing your policy easier.

Illinois is the state with the lowest car insurance rates

If you're looking for car insurance in Illinois, you've come to the right place. Illinois has some of the lowest insurance rates in the nation. The rates you pay depend on several factors like your driving record, age, and driving history. In part, older drivers pay higher rates because they are at greater risk for car accidents. However, you can reduce your rates in a few ways. Look into discounts. A low mileage discount or defensive driving course may be available to you. If your vehicle has anti-theft technology, you may be eligible to receive an Illinois auto insurance discount.

The Insurance Information Institute reports that 11.8% of Illinois residents don't have insurance. However, this number is considerably lower than the national average of 12.6%. An additional way to cut down on your insurance costs is by improving your credit score. This will help you not only with auto insurance rates but also other areas of your finances.

Moovit app for cheap car insurance quotes

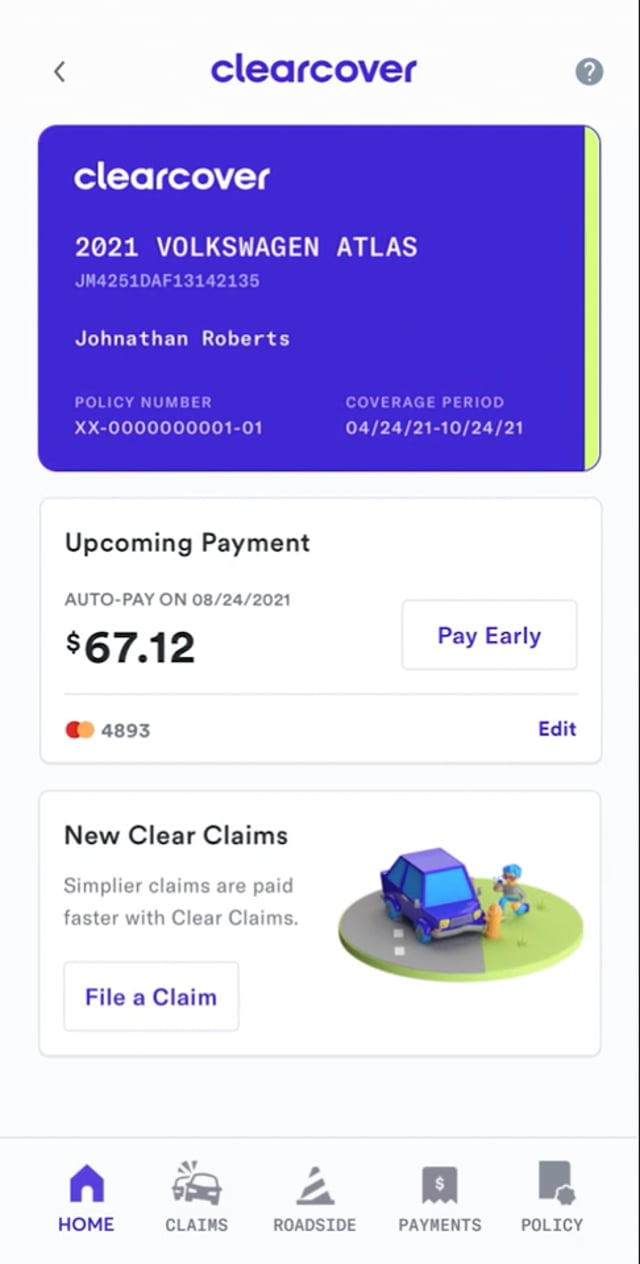

It's impossible to ignore the importance of car insurance in 21st century. Just like marriage, it is a necessity that needs to be protected in case of an accident. Many apps are now available that can help consumers find the best rates on car insurance. One such app is Way, which claims to have saved more than $50 million dollars by 2020 for its customers. The app compares over 50 insurance companies to help users choose the best car insurance rates.

The Moovit app is a great tool to locate cheap car insurance. The app's simple-to-use interface allows you to quickly compare quotes from various car insurance providers and choose the right policy for you.

Online car insurance quotes

An excellent way to compare car insurance rates in Illinois online is to obtain free quotes. There are many companies to choose, including well-known names such as State Farm Insurance and GEICO. Country Financial and State Farm are two examples of regional insurances you might consider. Different rates are calculated using different methods by different companies.

Illinois drivers who live in Champaign, Naperville, and Peoria can expect to pay a 10% lower for their coverage. Drivers living in Joliet and Aurora can expect to pay about the same as the state average rate. Those living in Chicago, however, can expect to pay anywhere from 10% to 36% higher.

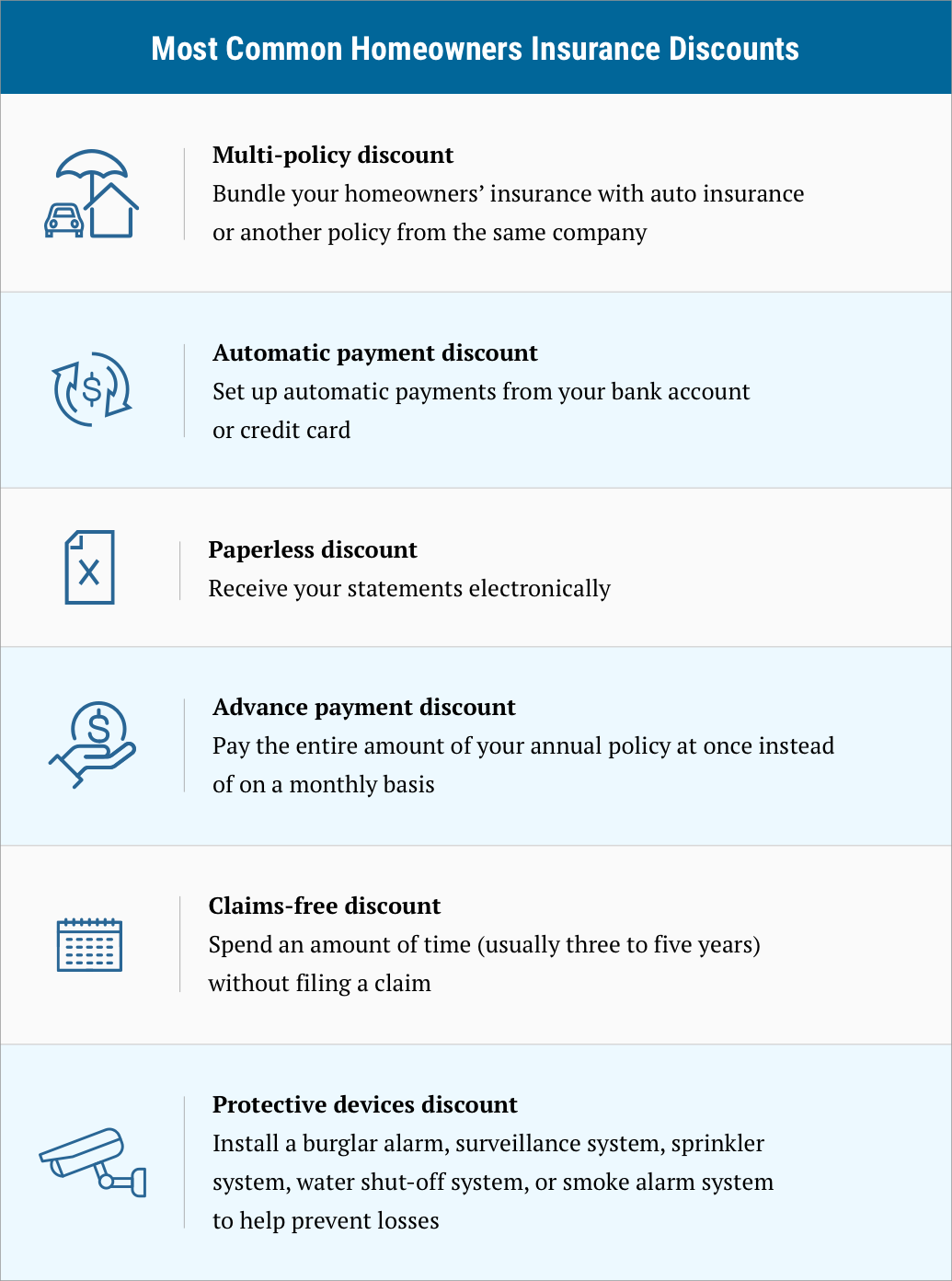

Special discounts for drivers who are good

There are many ways to save money on your car insurance. This includes discounts for high-performing drivers. A local insurance company can help you get lower car insurance. They may offer better deals than national insurance companies and have comparable customer satisfaction ratings. Many factors will affect your car insurance rates, including your driving record and claims history. Some insurance companies also factor in your age, gender, marital status, and annual mileage when calculating your premiums.

A good driver can also help you save money on your car insurance. Illinois law mandates that insurance companies offer discounts to 55-year-old drivers who take a crash prevention class. The classroom instruction must be at least 8 hours long. After completing the course, you will receive a certificate and a discount for three years. You can also save money if you drive the right kind and model of vehicle. Some of the best vehicles to insure in Illinois include the Honda CR-V LX, Subaru Crosstrek, and Jeep Wrangler JL Sport.

Cost of coverage depending on zip code

When looking for auto coverage, you should consider factors such your ZIP code or the location where you live. Different ZIP codes will be rated differently depending on different factors. These factors may change over time. For example, crime rates may be decreasing in one neighborhood, but your rate might go up in another if a new company starts in the area.

Another factor affecting your rate is the number of accidents in your area. Both you and the insurance company will be charged more for higher accident rates. The Insurance Institute for Highway Safety keeps records about fatalities and vehicle crashes. According to statistics, the highest accident rates are found in states that have low numbers of accidents. California, Texas, Florida and Florida are, however, the states with the highest accident rate.