Many employers consider health insurance a crucial part of their compensation package. However, the cost of these benefits is on the rise for over a decade. These factors include rising deductibles and prescription drug costs, as well as the increasing cost of health system pricing. These trends are driving both the rise in premiums as well as depressing wages. Many employers are unhappy with rising costs and increasing administrative burdens. Some employers are searching for non-wage alternative jobs.

Employers increasingly use wearable devices to improve their wellness programs. One survey found that one-fifth of employers collect data from employees' devices. Although the main driver of the market for health insurance is price increases, employers are now looking at other payment options to keep their employees healthy.

According to the Congressional Budget Office (CBO), the number Americans who are covered by employer-sponsored health plans will remain the same 159million in ten year. This means that health insurance will remain a tax-favored option. In 2019, however, the cost for single coverage will exceed 9.86 percent of household income.

Premiums cover not only the price of health insurance, but also the cost to pay deductibles. An estimated 25% of workers in the United States have a minimum $2,000. In the US, around 25% of workers have a minimum $2,000. The self-insured plan can save money if claims are low. Employers are responsible for paying extra if the claim is larger than they expected.

The age mix of employees determines the rates for small groups. Massachusetts has a median annual income of $1186 for workers younger than 25 and an average annual income of $6,896 for those older.

Employers with larger budgets have greater control over the coverage of their employees' plans. Large employers often offer biometric screenings to employees. They also provide a wellness program for employees and encourage them to go to lower-cost providers. Public sector employers can also customize their health plans to meet employees' needs.

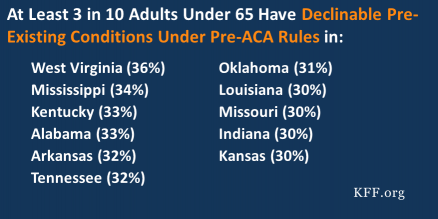

Employers with 51 to 100 employees will be moved by the Affordable Care Act into a merged marketplace for 2016 health insurance. These employers will pay premiums that can go up to 9 %. It also requires the states to set an annual rate. The annual penalty for those who don't provide affordable plans is $3,480

Some small employers may need to make additional contributions in order to subsidize their employees' health insurance. Massachusetts is an example of a state where employers are required to contribute $50 per employee annually.

Despite these requirements however, there is still a decrease in the number of employers that offer health insurance. After a decade-long period of rapid increases in benefits costs, many small businesses are becoming frustrated at the uncontrollable high cost. While most employers do not see an increase in their health insurance rates, some find it difficult to retain staff.

As unemployment remains low, so is the difficulty in keeping employees. This is a major problem for employers. Employers that don't offer their employees health insurance will face a $2320 per-employee penalty. In addition to the fines, COBRA is a law that requires employers and employees to provide continuous health care.