Homeowners insurance Nebraska protects both your home and its contents from many risks. The policy can provide liability coverage should you be found liable for damage caused to another person. It is important to purchase insurance coverage, because it will help you recover in the event of a catastrophe or injury that causes property damage or medical costs.

Nebraska homeowners' insurance will usually include the following categories.

Dwelling Insurance: This is a common insurance that covers your home and its attached structures. This also includes plumbing, heating systems, and permanently mounted air conditioning units.

Other Buildings Coverage: A more comprehensive option, this covers detached garages, toolsheds, retaining wall, and any other structures that you have on your property.

Personal Property coverage: This can be one of the most crucial aspects of your Nebraska homeowners insurance plan, as it helps cover your belongings if they are damaged or taken. Also, it provides protection from vandalism, water and fire damage.

Identity Theft coverage is an essential part of Nebraska homeowners insurance policies, as it protects against fraud and theft. You can also recover from damage done to your credit rating.

Flooding coverage is an important part of Nebraska homeowners insurance policies. It helps to cover the costs of repairs and replacements caused by water damage. It can also prevent future floods.

The Nebraska homeowners' insurance policy should include coverage for storms and hail. It is an important feature of Nebraska homeowners insurance and can provide homeowners with peace ofmind if they reside in areas that are prone to tornadoes or hailstorms.

You can also choose from a variety of additional coverage options:

It can be hard to select the right homeowners insurance when there are many providers on the market. With the help of an independent agent, you can get the right coverage at the price that suits your budget.

As a Nebraska homeowner, you can also benefit from discounts. These discounts may reduce your annual premium for homeowners insurance by up 20%.

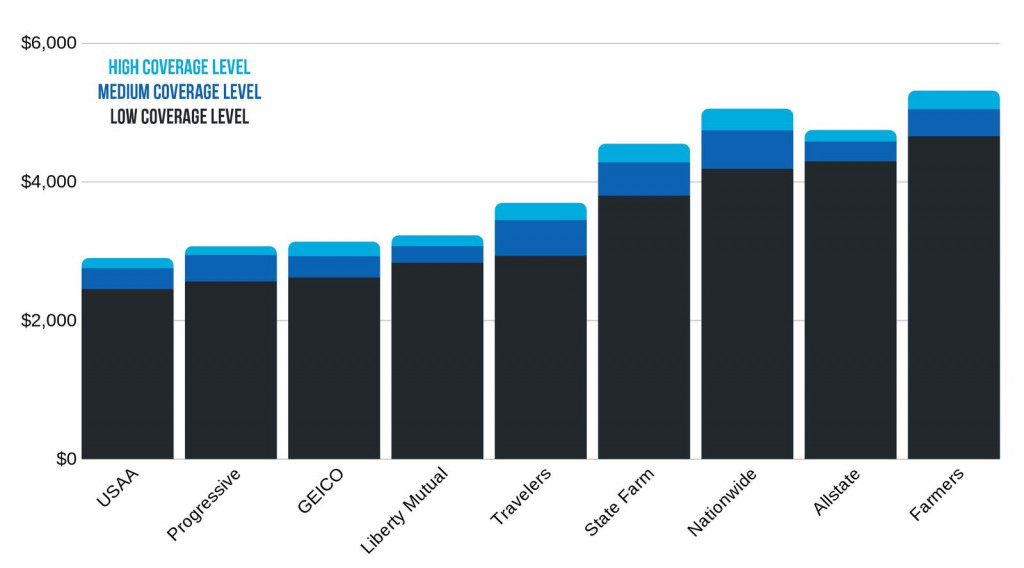

Comparing homeowners insurance quotes is the best way to determine which company is for you. This can be done by requesting quotes for several of the top insurance companies in Nebraska.

Bundling is often a good idea. Insurers will sometimes give discounts for purchasing multiple policies through the same company. You can save on homeowners insurance as well as other types of insurance such a auto or life.

You should also request an On Your Side review. This allows you to look for any gaps in your policy or other concerns that might need attention. You can easily make small adjustments that will help you save money in the long run.